Kwsp Rate Table

Both the rates of contribution are based on the total monthly wages paid to the employee and contributions should be made from the first month the employee is employed. 6 реда Ref Contribution Rate Section C More than RM5000.

Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2021.

Kwsp rate table. Janji Temu Online Plan your appointment at ease online. The new rates will be in effect for the whole year of 2021 affecting. Careers Make a difference with us.

Corporate Information Who we are what we do. The completed form must then be submitted to their respective employers for online registration via i-Akaun Employer which will begin from 14. For employees who receive wagessalary exceeding RM5000 the employees contribution of 11 remains while the employers contribution is 12.

We have a client with employees in Malaysia who we informed about the new EPF contribution rates. For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13. Investment income Non-investment income Expenses b Total for a 1 dividend is based on.

Monthly salary greater than RM5000. Because the rate was a reduction the employee had the option to maintain the previous 11 contribution rate to increase their retirement savings or to elect the new lower 9 rate. Employee Provident Fund Epf Kwsp Epf Act 1991 Act 452 Third Schedule Factor Income Distribution Employment Compensation.

Epf Interest Rate Hike Ahead You Can Become Crorepati On Basic Pay Of Rs 15 000 Zee Business. Employee contributes 9 of their monthly salary. For Non-Malaysians registered as members from 1 August 1998 section B of EPF Contribution Table.

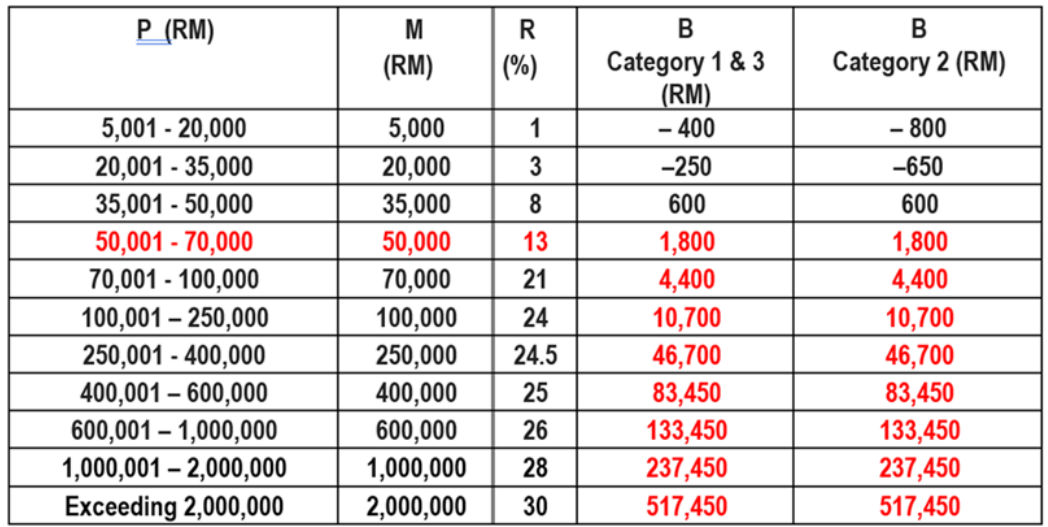

Dividend Rate Net income a x 1 Total for a 1 dividend b where a Net income. Calculate monthly tax deduction 2021 for Malaysia Tax Residents. New statutory contribution rate of 2021 - 9 or 11.

Starting for the year of 2021 the minimum statutory contribution rate for employee contributions will go down from 11 to 9. Meantime the rates of contribution for employed individuals between 60 and 75 will be set at 55 for the employees. AMOUNT OF WAGES RATE OF CONTRIBUTION FOR THE MONTH FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 154001 to 156000 18800 17200 36000 From 156001 to 158000 19000 17400 36400.

KWSP - EPF contribution rates. Employees who wish to maintain the statutory contribution rate at 11 are required to apply via Borang KWSP 17A Khas 2021 which will be made available on the KWSP website wwwkwspgovmy from 1 December 2020 onwards. Employer contributes 12 of the employees salary.

The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme. Cara Isi Borang KWSP 17A Khas 2020. 9 of their monthly salary.

For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary. January 2021s wages February 2021s contribution. In case you missed it the current EPF contribution rate reduction from 11 to 7 under the Economic Stimulus Package will end on the 31st December 2020.

Kadar Caruman KWSP Terkini Menerusi Pakej Rangsangan Ekonomi 2020 kadar caruman syer pekerja KWSP tahun 2020 telah dikurangkan daripada 11 peratus kepada 7 peratus. And 6 for those earning above RM5000 or 65 for those earning RM5000 and below for the employers. For late contribution payments employers are required to remit.

Employers are required to remit EPF contributions based on this schedule. For members who wish to retain the normal 11 contribution rate for 2021 you may fill up the Borang KWSP 17A Khas 2021 form which will be made available on the EPF website from 1st December 2020. 26 реда Historical Employees Provident Funds EPF KWSP Dividend Rate.

EPF Contribution Schedule Third Schedule The latest contribution rate for employees and employers effective January 2019 salarywage can be referred in the Third Schedule EPF Act 1991 click to download. Minimum Employers share of EPF statutory. Media Publications Happenings activities in the EPF.

Employees who receive wagessalary exceeding RM5 000 the employees contribution of 11 remains while the employers contribution is 12. Epf Interest Rate From 1952 And Epfo. Socso Table 2019 For Payroll Malaysia Smart Touch Technology.

The employees would have to fill out a form to maintain the old rate. When it takes effect and end. Ia berkuatkuasa mulai upah pekerja April 2020 caruman Mei 2020 sehingga upah pekerja Disember 2020 caruman Januari 2021.

Employees aged 60 and above. Procurement Apply for tenders or submit a quote.

Epf Contribution Rates 1952 2009 Download Table

Sage Ubs Software Ubs Update Payroll Epf Statutory Contribution Rate Setup Effective On August 2013

Employee Provident Fund Epf Kwsp Epf Act 1991 Act 452 Third Schedule Factor Income Distribution Employment Compensation

Epf Contribution Rates 1952 2009 Download Table

20 Kwsp 7 Contribution Rate Png Kwspblogs

Download Employee Provident Fund Calculator Excel Template Exceldatapro

What Does The 6 40 Epf Dividend Mean To Your Savings Imoney

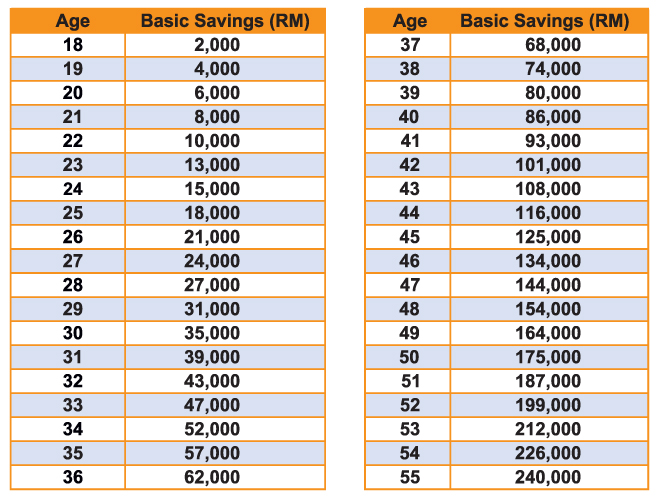

Kwsp Epf Sets Rm228 000 As Minimum Target Savings At Age 55 Asset Display Page

New Statutory Contribution Rate Of 2021 9 Or 11

20 Kwsp 7 Contribution Rate Png Kwspblogs

Posting Komentar untuk "Kwsp Rate Table"