Kwsp Rate Calculator

Can I retire at age 55. All information above can be found in online KWSP account statement.

Obtain EPF Basic Saving Required amount in Account 1 effective Jan 1 2019 Calculate amount 30 available for Unit Trust investment 2.

Kwsp rate calculator. To use the Employees Provident Funds calculator key-in the following informations. For employees who receive wagessalary exceeding RM5000 the employees contribution of 11 remains while the employers contribution is 12. If you have staff who opt for 11.

Check your eligibility. Many people rely on their EPF Saving. Unit Trust EPF Calculator KWSP Malaysia.

Malaysia Insurance Portal - EPF Calculator. Try out our calculators for all your needs. For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary.

Opening balance of account 1 and 2 from the previous year. Wages Subject to EPF Contribution. Unit Trust EPF Calculator KWSP Malaysia This app is useful for Unit Trust consultants who need 1 app with 3 calculator types 1.

Please note that the EPF contribution rate and the amount must be calculated by EPF calculator and EPF table based on the contribution rate specified in the Third Schedule of the 1991 EPF Act instead of using an exact percentage calculation except for salaries in excess of RM20000. Considering that the EPF is paying 875 this year this is the equivalent of a 1250 rate of interest for somebody in the 30 tax bracket. Personal rate is 11 Employer calculation rate is 13.

Our EPF calculator will help you to estimate your Employee Provident Fund EPF corpus at the time of retirement. Listed below are the yearly dividend rates paid out by EPF beginning 1952 until now 2019. Just carefully check it then it should be all-set.

From 1st until 30th January dividend is calculated as follow Account 1 dividend 70000 x 565 365 x 30 days 32507. Earnings used to calculate Employer EPF statutory rate is RM 4540 Statutory EPF EE Contribution Rounded EPF Base Statutory Rate 5800 8 RM 464 Voluntary EPF EE Contribution Original EPF Base Personal Rate - Statutory Rate 5779 11 - 8 3 1734 Round to the next Ringgit RM 174. For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13.

In you have withdrawal key-in the date of withdrawal and respective amount in the correct account. Employees need to fill up the Borang KWSP 17A KHAS 2021 to maintain current contribution rate of 11 which is now available at here. This app is useful for any person interested in Unit Trust EPF Investment Scheme.

EPF Contribution Rate For EPF Calculator Payroll Malaysia The employees monthly statutory contribution rates will be reverted from current 8 to the original 11 for employees below age 60 and from 4 to 55 for those age 60 and above effective January 2018 wagesalary. Malaysian Payroll Software and Salary Calculation. Dividend Rate Conventional Account.

Calculate monthly tax deduction 2021 for Malaysia Tax Residents. EPFKWSP Dividend Rates History. For the months where the wages exceed RM2000000 the contribution by the employee shall be calculated at the rate of 11 of the amount of wages for the month and the contribution by the employer shall be calculated at the rate of 12 of the amount of wages for the month.

Calculate EPF Amount 1 withdrawals for 4 times using 30 limit 3. On 31st on January dividend is calculated as follow Account 1 dividend 70000 700 x 565 365 1094. Employees who receive wagessalary exceeding RM5 000 the employees contribution of 11 remains while the employers contribution is 12.

65 Ref Contribution Rate Section C More than RM5000. Minimum Employers share of EPF statutory. 13 Ref Contribution Rate Section A Applicable for ii and iii only Employees share.

12 Ref Contribution Rate Section A. Ref Contribution Rate Section E RM5000 and below. This interest rate.

Interest earned on EPF is the equivalent of a high pre-tax rate. Pay EPF as usual. Potongan Wajib Mengikut Slip Gaji KWSP.

ESTIMATES YOUR EPF FUND. Based on new 45 dividend 22nd March 2009 Age required. Obtain EPF Basic Saving Required amount in Account 1 effective Jan 1 2019 Calculate amount 30 available for Unit Trust investment first withdrawal useful for a person with small EPF amount.

Account 2 dividend 30000 x 565 365 x 30 days 13932.

View Kwsp Contribution Rate 2020 Employer Images Kwspblogs

Confluence Mobile Community Wiki

Confluence Mobile Community Wiki

Time Value Of Money Computing The Retirement Fund In Epf Account Of An Employee Kclau Com

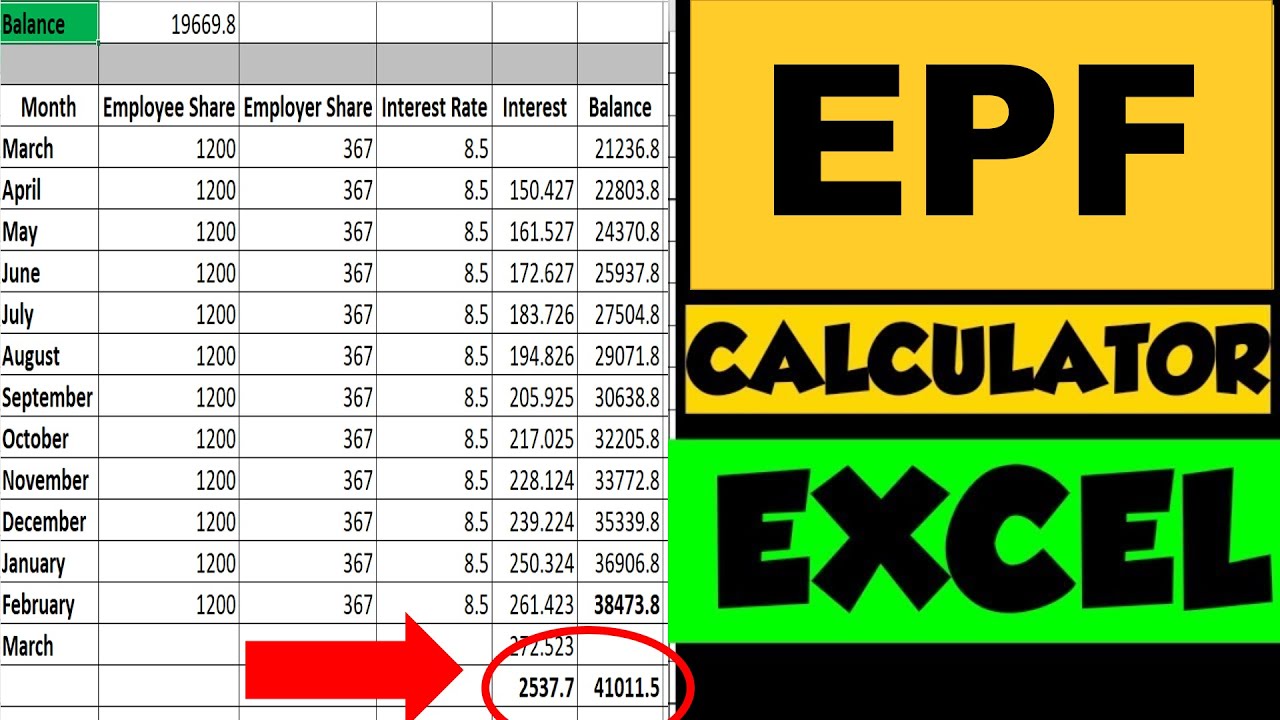

Epf Excel Calculator Employee Provident Fund How To Calculate Epf Interest With Epf Interest Rate Youtube

How To Download And View Epf Statement Online Plan Your Finances

What No One Is Telling You Epf Is Not Enough The Rojak Pot

Https Www Kwsp Gov My Documents 20126 1275785 12 Easy Guide Gov Share Dividend Calculator Pdf

15 Benefits Of Having Epf Account

Epf Account 1 Withdrawal How To Apply An Online Epf Account I Account On Kwsp Uan Mobile Number Dag Ewu

Posting Komentar untuk "Kwsp Rate Calculator"