Malaysia Withholding Tax Rate On Services

The special classes of income are those listed in section 4A of the Income Tax Act 1967 ITA. Goods and Services Tax GST Introduced in April 2015 GST Goods Services Tax is the value added tax VAT in Malaysia.

These proposals will not become law.

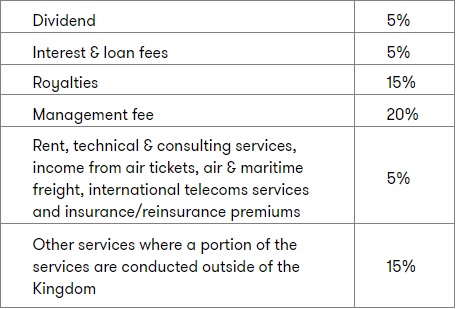

Malaysia withholding tax rate on services. Deemed derived from Malaysia and chargeable to tax under paragraph 4Ai of the ITA. The gross amount of Special Classes of Income paid for the above services rendered by a NR payee is subject to withholding tax at 10 or any other rate as prescribed in the Double Taxation Agreement between Malaysia and the country in which the NR payee is tax resident. Withholding tax means an amount representing the tax portion of an income of a non-resident recipient withheld by the payer in Malaysia and paid directly to the Inland Revenue Board of Malaysia IRB.

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices. The words used have the following meaning. Withholding tax rates are 10 3 The 10 is in respect of the tax liabilities of the non-resident contractor while the 3 is for the tax liabilities of the employees of the non-resident contractor.

For Sales Tax goods other than petroleum products which are not exempted from Sales Tax or not prescribed to be. Withholding Tax Rate The withholding tax rate for both services and royalties is 10 but depending on the tax treaty between Malaysia and the respective countries the. Tax portion of income.

This booklet also incorporates in coloured italics the 2021 Malaysian Budget proposals announced on 6 November 2020 and the Finance Bill 2020. 102019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. In simpler terms if you are paying non-local foreign vendors you need to withhold a certain of the invoiced amount and pay to LHDN as a form of tax and the remaining.

B Installation and commissioning services Example 3 Champ Ltd a company resident in India sold 3 stainless steel boilers to. The Inland Revenue Board of Malaysia recently published two practice notes regarding the changes in withholding tax requirements on service payments introduced as part of the Finance Act 2017 Act 785 which include that payments for services to non-residents are now subject to a 10 withholding tax regardless of where the services are performed. 77 rows Withholding tax is a method of collecting taxes from non-residents who have derived.

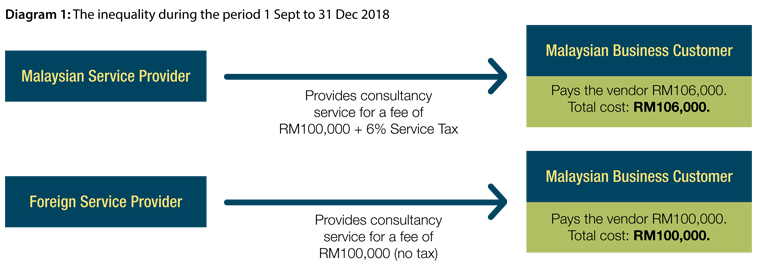

Services Rendered in Connection with the Use or Installation or Operation of. 20202021 Malaysian Tax Booklet. To level the playing field so to speak the government has decided to impose a 6 service tax on ITS.

10 December 2019 Page 4 of 42 The fees of RM2 85714 is subject to a withholding tax of 10 under section 109B of the ITA. However certain intra-group services would not be taxable subject to the fulfilment of certain criteria. Sales Tax and Service Tax were implemented in Malaysia on 1 September 2018 replacing Goods and Services Tax GST.

This amount has to be paid to LHDN. What supplies are liable to the standard rate. The prevailing WHT rate is 10 except where a lower rate is provided in an applicable tax treaty.

WITHHOLDING TAX ON SPECIAL CLASSESS OF INCOME Public Ruling No. The gross amount paid to B Ltd is subject to withholding tax under section 109B of the ITA at the rate of 10. GST Malaysia of 6 has been implemented to replace the consumption tax comprising the sales tax and the service tax SST.

Specific tax rate for specific purpose of such income. With effect from 1 January 2020 digital services are also included as a taxable service. Remuneration or other income in respect of services performed or rendered in Malaysia by a NR public entertainer is subject to withholding tax of 15 on the gross payment.

The withholding tax in Malaysia is an amount withheld by the party making payment payer on income earned by a non-resident payee. Taxable services include a long list of professional services but when rendered by overseas providers it is often exempted from service tax because the service provider is not in Malaysia. Service tax is levied at a rate of 6.

10 for Sales Tax and 6 for Service Tax. When contract payments are made to a non-resident contractor in respect of services under a contract such payments are subject to WT. This is a final tax.

There is no value-added tax in Malaysia since the abolishment of the goods and service tax GST regime. In simple term these are.

Payroll And Tax Services In Malaysia Tax Services Payroll Taxes Payroll

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today

Four Pillars Of Qualified Intermediary Compliance Qualified Intermediary Tax Services Pwc

Panama Tax Treaties Tax Panama

Global Corporate And Withholding Tax Rates Tax Deloitte

Payroll And Tax In Luxembourg Payroll Corporate Tax Rate Income Tax Brackets

Withholding Tax Service Tax On Imported Services For Digital Ads Services

Global Corporate And Withholding Tax Rates Tax Deloitte

Tax And Finance Tips How To Find The Best Payroll And Tax Services In S Tax Services Payroll Payroll Taxes

Posting Komentar untuk "Malaysia Withholding Tax Rate On Services"